Cheap car insurance for ladies can offer lower premiums and specific benefits. Insurers recognize that women statistically pose a lower risk.

Securing affordable car insurance is a priority for many female drivers, as they search for policies that cater to their needs without breaking the bank. Insurance companies may provide competitive rates for women based on the lower likelihood of engaging in risky driving behaviors, leading to fewer accidents and claims.

This understanding often results in more attractive insurance packages for ladies, including incentives like no-claims bonuses and discounts for safe driving. Women need to compare different insurers and take advantage of online tools and resources to find the best rates tailored to their driving profiles.

Proper research ensures that female drivers enjoy comprehensive coverage while maintaining cost-effectiveness. Remember, the key is to shop around and assess each policy’s benefits beyond the sticker price.

Why Car Insurance Rates Can Be Lower For Women

Statistics reveal women often incur fewer accidents, so insurers offer them reduced car insurance rates. Cheap car insurance for ladies reflects an assessment of risk, favoring cautious, rule-abiding female drivers.

When it comes to car insurance, not all drivers are created equal. Women often reap the benefits of lower premiums. This is due to a blend of factors that influence how insurance companies assess risk and assign costs. Below are key insights into why ladies may find themselves paying less for their auto insurance.

Risk Factors And Gender Statistics

Insurance rates stem from an assessment of risk. Studies and statistics illuminate fascinating trends:

- Women tend to drive fewer miles than men, reducing the likelihood of accidents.

- Their driving style is generally more cautious.

- Men receive more DUI infractions, a significant factor in accident rates.

These aspects form the backbone of why women often see friendlier rates on their car insurance policies. Insurers weigh these risk factors heavily when evaluating an application.

Insurance Companies’ Perspective On Gender

From an insurer’s standpoint, gender plays a role in the prediction of claim frequency. Actuarial data suggests women are less likely to be involved in severe crashes. Women pose a lower financial risk to insurers. This translates to potential savings in payouts from the insurance company. Companies then pass on these savings in the form of lower premiums for female drivers.

Understanding these gender-based savings can empower women to hunt for the best insurance deals. Thus, making an informed choice can lead to significant cost savings over time on their car insurance premiums.

Essential Tips For Finding Affordable Car Insurance For Women

Shopping for car insurance can be as savvy as finding that perfect little black dress on sale. Smart choices lead to great deals, especially for women seeking affordable options. Let’s dive into some pro tips guaranteed to steer you toward saving money and cruising with the right coverage.

Comparison Shopping Strategies

Digging up the best insurance deals is all about comparing options. It’s much like shopping for a pair of shoes; you wouldn’t buy the first pair without checking another store for a better price or a nicer style. Apply these strategies:

- Check Multiple Providers: Visit various insurers’ websites or use comparison tools.

- Understand Coverage Types: Know what coverage you need—don’t pay for what’s unnecessary.

- Review Annually: Insurers change rates. Always look for better deals each year.

Taking Advantage Of Discounts

Car insurance companies love rewarding customers who show prudent driving habits and responsible behavior. Below are some discounts women drivers might be eligible for:

| Discount Type | Description |

|---|---|

| No-Claim Bonus | For years without claims, premiums can drop. |

| Multi-Car Discounts | Insure more than one car; save money on each. |

| Defensive Driving Courses | Complete a course, and some insurers reduce rates. |

| Pay In Full | Pay your yearly policy upfront and receive discounts. |

Rack up even more savings by bundling car insurance with home or renters’ insurance. Showing proof of a good driving record and a high credit score can lead to sweet deals as well. Dive into these discounts and swim in the savings!

Types Of Car Insurance Coverage Women Should Consider

Shopping for car insurance can be overwhelming, but it’s essential to understand the different types of coverage available. Ladies, it’s important to choose the right insurance to protect yourself on the road. Let’s explore the coverages that can keep you and your vehicle safe without breaking the bank.

Mandatory Vs. Optional Coverage

Mandatory coverage is the basic insurance every driver needs. It often includes liability coverage, which pays for damage you cause to others. This is required in most states.

On the other hand, optional coverage is not required by law but can provide added protection. Examples include roadside assistance and rental car coverage. In the long term, these solutions can save you stress and money.

- Liability Insurance: Covers others’ injury or damage costs.

- Uninsured Motorist Protection: Helps when the other driver lacks insurance.

- Personal Injury Protection: Pays for your medical expenses.

- Rental Car Coverage: Insures your rental in case of an accident.

Understanding Collision And Comprehensive Insurance

After an accident, collision insurance pays for repairs to your car. Whether it’s with another car or a stationary object, collision coverage has you covered. It can be a financial savior, especially with newer, valuable cars.

Comprehensive insurance is for non-collision damage. Think of things like theft, vandalism, or natural disasters. This coverage is peace of mind in unpredictable situations. Young ladies, including both coverages, could mean fewer worries on and off the road.

| Type of Coverage | What It Covers |

|---|---|

| Collision | Car repairs after a crash. |

| Comprehensive | Non-accident related damage. |

Remember to consider add-ons, like glass coverage for windshield repairs, and gap insurance if your car is financed. These could prevent financial hassles after mishaps.

How Age And Driving Experience Affect Insurance Rates For Women

Shopping for car insurance can be quite different for women, especially when age and driving experience come into play. It’s well-documented that these factors influence insurance premiums significantly. This section dives into the nitty-gritty of how age and experience can impact car insurance rates specifically for ladies.

Impact Of Age On Premiums

Age acts as a marker for insurers to gauge risk and potential claim frequency.

- Younger female drivers often face higher rates. This is due to their inexperience on the road.

- As women grow older, their premiums tend to decrease. Stability and experience result in lower risk.

- Age 25 is a notable milestone. Insurers commonly reduce premiums at this point.

But there’s a twist. After a certain age, usually around 65, premiums may start to increase again. This is due to the higher accident risk associated with older age.

Ways To Lower Costs For Young Or New Female Drivers

Despite higher rates for young or new female drivers, there are strategies to cut costs.

| Strategy | Effect on Cost |

|---|---|

| Defensive Driving Courses | May qualify for discounts |

| Good Student Discounts | Offers savings for high academic performance |

| Telematics Programs | Monitors driving behavior, potentially leading to lower rates |

Beyond these strategies, shopping around for competitive rates and bundling insurance policies are also effective. Maintaining a spotless driving record is crucial.

Parents adding young drivers to existing policies can bring about considerable savings. Plus, opting for a higher deductible can lower premiums as well.

Maximizing Savings Without Compromising Protection

Finding affordable car insurance for ladies doesn’t mean losing quality coverage. Smart strategies exist to keep rates low while ensuring excellent protection. Let’s unlock the secrets to maximizing savings without cutting corners.

Bundling Policies For Discounts

Combining multiple insurance policies can lead to significant discounts. Women who have more than one insurance need, such as home or renters along with auto, can save money by sticking with a single insurer. Here’s how it works:

- Bundle car insurance with other policies

- Receive a discount on overall premiums

- Lower the number of separate payments

This strategy brings convenience and cost-efficiency. It is vital to compare the bundled price against individual policies from different companies to ensure the best deal.

Regular Policy Reviews And Adjustments

Circumstances change, and so should your car insurance policy. Annual reviews help identify potential savings without losing out on essential coverage. Here is a checklist for policy adjustments:

- Review current coverage and limits

- Analyze changes in driving habits

- Update personal information

- Adjust coverage as needed

With life changes such as moving, changing jobs, or even improving your credit score, you might qualify for lower premiums. Regular reviews ensure your policy reflects the actual risk and that you are not overpaying.

The Role Of Deductibles In Car Insurance For Women

Understanding deductibles is key to finding cheap car insurance for ladies. A deductible is the amount paid out of pocket after an accident before your insurer covers the remaining costs. Choosing the right deductible can greatly affect your insurance premiums and potentially lead to significant savings.

Choosing the Right Deductible Amount

Choosing The Right Deductible Amount

It’s important to select a deductible that aligns with your financial comfort level and driving habits. Use these points to decide:

- Examine your savings: Pick a deductible you can afford in case of an accident.

- Consider driving frequency: If you drive less, a higher deductible may be a smart choice.

- Assess your car’s value: A lower deductible might suit a new, pricier vehicle.

How Deductibles Influence Annual Premiums

How Deductibles Influence Annual Premiums

The deductible amount has a direct impact on your annual car insurance premium. Lower premiums are typically the result of a bigger deductible. This table helps illustrate the relationship:

| Deductible Amount | Annual Premium |

|---|---|

| $250 | Higher Premium |

| $500 | Medium Premium |

| $1000 | Lower Premium |

Choosing a higher deductible could save you money year-round. Always measure this against your ability to handle unexpected expenses.

Cheap Car Insurance For Ladies Online

In today’s digital age, finding cheap car insurance for ladies online has become easier and more convenient than ever. With just a few clicks, women can access a plethora of options tailored specifically to meet their needs, offering them the chance to save money while still securing comprehensive coverage.

This boon not only simplifies the process of comparing different policies but also empowers ladies to make informed decisions from the comfort of their homes.

Whether you’re a young driver or a seasoned motorist, exploring cheap car insurance for ladies online can lead to significant savings without compromising on quality. So, if you’re in the market for an affordable, reliable car insurance solution, diving into the online world could be your best bet for finding the perfect match.

Ladies Car Insurance Over 50

For lady’s car insurance over 50, the market offers a variety of specialized options that cater specifically to the mature driver. This demographic is often seen as less of a risk by insurers, thanks to years of driving experience and a tendency towards more cautious driving habits.

As a result, ladies’ car insurance over 50 can be surprisingly affordable, offering extensive coverage without breaking the bank.

The key to unlocking these savings lies in shopping around and comparing policies tailored for the over 50s. Many insurance companies recognize the value of mature lady drivers and offer discounts and benefits that reflect their lower risk profile.

From no-claims bonuses to reduced rates for low mileage drivers, there are numerous ways to save on ladies’ car insurance over 50.

Engaging in this search can not only ensure that you’re fully protected on the road but can also provide significant financial savings, making it a win-win situation for savvy lady drivers looking to maximize their insurance investments while enjoying the peace of mind that comes with comprehensive coverage.

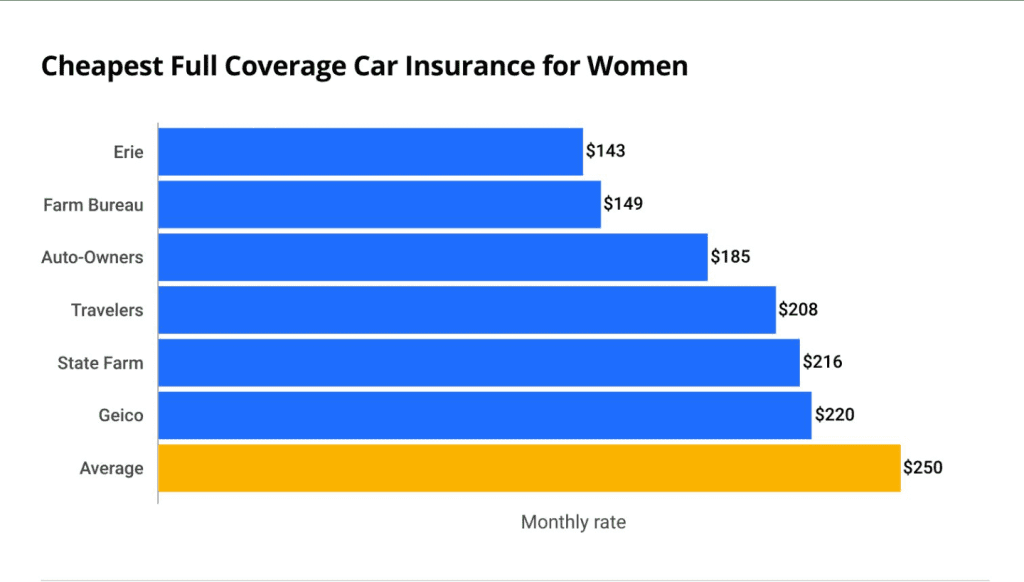

Best Car Insurance For Women

Finding the best car insurance for women involves looking for policies that offer a combination of affordability, comprehensive coverage, and customer service tailored to suit the unique needs of female drivers.

Insurers often consider women to be lower-risk drivers, a perspective that can lead to more competitive rates and discounts specifically designed for female motorists.

The best car insurance for a woman typically includes features such as no-claims bonuses, coverage for personal belongings inside the vehicle, and roadside assistance, ensuring peace of mind while on the road.

To secure the best deal, women should compare quotes from multiple insurance providers, taking into account not just the price but also the level of coverage and the reputation of the insurer for customer satisfaction and claims handling.

Additionally, many companies now offer online tools that make it easier to customize policies, allowing women to adjust their coverage levels and deductibles to match their driving habits and budget. By thoroughly researching and taking advantage of available discounts, such as those for safe driving or bundling policies, women can find the best car insurance that offers both protection and value.

Go Girl Insurance

Go Girl Insurance is a brand that specifically targets female drivers, offering car insurance policies designed with women in mind.

The brand emphasizes providing affordable, straightforward car insurance solutions, aiming to support women drivers with comprehensive coverage that meets their needs. Go Girl Insurance often highlights features such as online policy management, allowing customers to easily adjust their policies and make claims digitally, which adds convenience and efficiency to the customer experience.

Their approach typically includes offering competitive rates for women, and understanding that female drivers statistically present a lower risk, which can lead to more favorable insurance premiums. Go Girl Insurance may also offer additional benefits such as a courtesy car during repairs and cover for personal belongings in the car, enhancing the value of their policies.

For women looking for car insurance, Go Girl Insurance aims to be an attractive option by combining tailored services with the promise of reliability and customer-centric support.

As with any insurance provider, potential customers need to review the details of coverage options, and customer testimonials, and compare quotes to ensure they’re getting the best deal for their specific driving needs and circumstances.

Pink Lady Insurance

Pink Lady Insurance” seems to evoke the idea of a car insurance product or company that specifically targets female drivers, similar in concept to brands that aim to cater to the unique needs and preferences of women.

While “Pink Lady Insurance” may not be a recognized brand or company name as of my last update, the notion behind it suggests a focus on providing car insurance solutions that are not only affordable and comprehensive but also tailor-made for women, emphasizing security, reliability, and customer-friendly services.

Such insurance might offer features appealing to female drivers, including competitive pricing, rewards for safe driving, comprehensive coverage options, and additional perks like roadside assistance, coverage for personal items inside the vehicle, and perhaps even special support services in case of accidents.

The idea would also lean towards simplifying the process of managing and claiming insurance through user-friendly digital platforms, making it convenient for busy women to handle their car insurance needs with ease.

When looking for insurance options like “Pink Lady Insurance,” it’s essential for consumers to research and compare different insurance providers to ensure they receive the best coverage that suits their specific needs, driving habits, and budget. Checking for customer reviews, coverage options, claim process efficiency, and additional benefits can help in making an informed decision.

Car Insurance For Females Under 25

Car insurance for females under 25 often comes with the challenge of higher premiums due to the perceived risk associated with younger drivers. However, insurance companies also recognize that female drivers, even those under 25, typically present a lower risk compared to their male counterparts. This can lead to slightly more favorable rates for young women seeking car insurance.

To find the best car insurance for females under 25, it’s crucial to shop around and compare quotes from various insurers. Many companies offer discounts specifically for young drivers who demonstrate safe driving habits, such as completing a recognized driver’s education course or maintaining a clean driving record. Additionally, some insurers might offer telematics programs, where a device is used to monitor driving behavior, potentially leading to lower premiums for those who prove to be safe drivers.

Other strategies to reduce car insurance costs include opting for a higher deductible, which can lower the premium but means paying more out-of-pocket in the event of a claim. Including a female driver under 25 on a family policy, rather than purchasing a separate policy, can also sometimes result in lower overall costs.

Ultimately, while car insurance for females under 25 can be expensive, leveraging discounts, carefully choosing the right coverage, and maintaining a safe driving record can help in securing more affordable rates. It’s also beneficial to review and adjust the policy as circumstances change, such as turning 25, which can significantly impact insurance premiums.

Frequently Asked Questions On Cheap Car Insurance For Ladies

Who Normally Has The Cheapest Car Insurance?

Typically, young drivers and seniors tend to find higher premiums, while middle-aged drivers with clean records often secure the cheapest car insurance. Insurers consider factors like driving experience, claims history, and vehicle models when determining rates.

What’s The Cheapest Type Of Car Insurance?

The cheapest type of car insurance is typically minimum liability coverage, which meets state-required standards.

What Is The Cheapest Car Insurance For A Woman Under 25?

The cheapest car insurance for a woman under 25 varies based on location, driving history, and vehicle type. To find the best rates, compare quotes from multiple insurers and consider discounts for safe driving, academics, or bundling policies.

Why Is Liberty Mutual So Cheap?

Liberty Mutual offers competitive pricing due to customized policies, various discounts, and operational efficiencies. They leverage technology to reduce costs and pass savings onto customers.

Conclusion

Securing affordable car insurance is crucial for budget-conscious female drivers. By following the tips shared, ladies can enjoy the best of both worlds: comprehensive coverage at a wallet-friendly price. Smart shopping and taking advantage of unique discounts will pave the way to significant savings.

Always compare rates diligently, and drive confidently knowing you’re fully protected without breaking the bank.

Koushik Kumar Sarkar, a seasoned content writer, specializes in demystifying insurance complexities. With a knack for crafting clear and engaging narratives, he empowers readers to make informed decisions about their coverage. Koushik’s expertise spans various insurance domains, making him a go-to resource for accessible and insightful content. Connect with him for concise, informative, and impactful insurance insights.