Cheap insurance cars for young drivers typically include models with safety features and low repair costs. The Ford Fiesta and Honda Civic often rank well for affordability and insurance premiums.

Insurance rates for young drivers can be strikingly high, given their lack of experience behind the wheel and the statistically higher risk of accidents associated with this demographic.

Manufacturers who design vehicles with excellent safety ratings, economical parts, and low maintenance requirements usually see their models favored by insurance providers.

As such, choosing the right car is crucial for young drivers looking to manage their expenses effectively. Good choices in this category can lead to significant savings, making car ownership more accessible and sustaining their mobility without financial strain.

It’s essential to balance cost with safety and reliability when selecting a vehicle, ensuring a prudent investment for those new to the road.

Affordable Auto Policies For The Youth

Finding affordable car insurance for young drivers is often a priority. Young drivers seek policies that won’t break the bank. Economical car insurance can help manage budgets while ensuring safety on the road.

Why Cost Matters

Insurance costs can take a big chunk of budgets for young drivers. Many are students or just starting careers. Lower insurance premiums help them save. It can make owning a car more feasible.

The Link Between Age And Insurance Premiums

Insurance companies often see young drivers as high-risk. This is due to their limited driving experience. Statistics show that accidents are more common in this age group. As a result, premiums for young drivers are higher.

Let’s explore cost-effective options for young drivers:

- Choose cars with a history of safety.

- Consider models with lower insurance costs.

- Look for discounts like good student or defensive driving courses.

Cost-efficient Models For Young Drivers

Some cars have lower insurance costs. Let’s see which ones young drivers should consider:

| Car Model | Insurance Friendly Features | Approx. Annual Premium |

|---|---|---|

| Honda Civic | Reliability, safety features | $1,200 |

| Ford Fusion | Top safety pick, smart tech | $1,150 |

| Subaru Outback | All-wheel drive, robust build | $1,100 |

Smart Moves For Lowering Premiums

There are strategies to reduce premiums for young drivers:

- Maintain a clean driving record.

- Opt for higher deductibles on your policy.

- Bundle auto insurance with other policies.

Final Thoughts On Auto Insurance For The Youth

Youthful drivers can find reasonable insurance plans. It’s crucial to compare options. Seek cars with low insurance costs. Practice safe driving. Take advantage of discounts. These steps will lead to sizable savings on auto insurance premiums.

Top Cars With Low Insurance Rates

Finding affordable car insurance can be a challenge for young drivers. Insurance premiums tend to be higher for this demographic, often making car ownership more expensive. Fortunately, some cars come with the benefit of lower insurance rates without compromising on quality or safety. Let’s explore the best options that can lead to significant savings.

Small Cars, Big Savings

Small cars are known for their affordability and fuel efficiency. These models also bring the advantage of lower insurance costs. Here’s a list of compact cars that don’t dig deep into your pockets:

- Ford Fiesta – Renowned for its reliable performance.

- Honda Fit – Offers great mileage and a solid resale value.

- Kia Soul – The large cabin and distinctive styling of the Kia Soul make it stand out.

| Car Model | Insurance Group | Approximate Annual Premium |

|---|---|---|

| Ford Fiesta | Group 7 | $1,200 |

| Honda Fit | Group 8 | $1,150 |

| Kia Soul | Group 9 | $1,100 |

Safety Scores And Premiums

The safer the car, the lower the potential insurance premiums. Young drivers can benefit from cars that excel in crash-tests with high safety ratings. This can reduce the risk of accidents and, in turn, insurance costs. Check out these models with outstanding safety scores:

- Subaru Impreza – Known for its all-wheel drive and robust safety features.

- Toyota Corolla – Comes with advanced driver-assist technologies.

- Mazda 3 – Features a suite of active safety systems as standard.

Selecting a car with top-notch safety equipment is a smart move. These models not only protect but also help keep insurance rates in check.

Factors Reducing Premiums For Young Drivers

Finding affordable car insurance can be a challenge for young drivers. Insurance companies often view young motorists as high-risk due to their lack of experience on the road. This results in higher premiums. However, several factors can help reduce the costs for these drivers. Comprehending these can result in noteworthy cost reductions.

Good Student Discounts

Insurers reward academic success with lower rates. They see good grades as a sign of responsibility, which translates to safer driving habits. Eligible students typically need a ‘B’ average or higher. Check with insurance providers to learn about their specific discount requirements.

- Eligibility: Usually, students with a GPA of 3.0 (or B average) qualify.

- Age Limit: This discount often applies to students up to age 25.

- Proof: You’ll need to provide a transcript or report card as evidence.

The Impact Of Driver Education

Taking a driver’s education course can lead to lower insurance premiums. Insurance companies value the additional training and improved skills that come from these courses. They often provide discounts to graduates. These courses focus on safe driving techniques, which can help avoid accidents.

Key advantages include:

| Driver Education Benefits | Impact on Insurance |

|---|---|

| Improved Skills: Better control and awareness on the road. | Potentially lower risk of accidents. |

| Knowledge: Understanding of traffic laws. | Fewer tickets and infractions. |

Always confirm with your insurance provider which courses are recognized for discounts. Complete a state-approved program to ensure eligibility.

Shopping For The Best Insurance Deals

Finding affordable car insurance is a big win for young drivers. Your mission: nab the lowest rates without sacrificing quality. Let’s dive into smart shopping tactics that keep your wallet happy.

Comparing Insurance Quotes

Start with quotes from different insurers. Never settle on the first offer. Use online tools to compare policies side by side. Look for coverage that matches your needs, at prices that don’t break the bank. Discounts can make a big difference—ask about a student or safe driver savings. Remember, a low price with poor coverage is no bargain. Quality matters.

When To Consider A Higher Deductible

The amount you pay as a deductible before insurance takes effect. Choosing a higher deductible can lower your premium, but it’s a balance. Go too high, and an accident could strain your savings. Stick with an amount you can cover without panic. Review your budget, think about your driving habits, and decide wisely. A smart deductible choice can lead to big savings.

Additional Ways To Cut Costs

Finding affordable car insurance for young drivers can feel like navigating a tricky maze. Yet, you can still discover paths to significant savings. Explore these clever strategies that go beyond the basics and help keep your premiums low.

Telematics And Usage-based Savings

Insurance companies love numbers, and they reward behaviors that reduce risk. Telematics devices track your driving patterns. They note how often you drive, the time of day, and how smoothly you handle the road. Safe driving can lead to discounts. These savings come from showing your insurer that you’re a low-risk driver. The benefits of good habits extend far beyond the road!

- Drive fewer miles? Get a discount.

- Brake and accelerate smoothly? Enjoy rewards.

- Stay off the road during risky hours? Bank the savings.

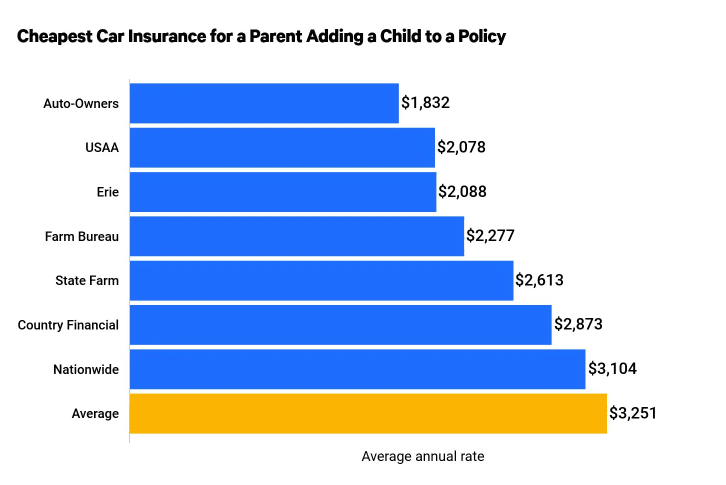

Parental Policy Piggybacking

If you’re a young driver, joining your parents’ insurance policy can save money. It’s often cheaper than getting your own. Insurers view your risk through the lens of the entire policy. This means the experience and good record of your parents can benefit you. Remember to check for multi-car discounts. Just ensure that your name is listed as a driver to keep everything above board.

- Combine policies for multi-car discounts.

- Benefit from your parents’ driving record.

- Make sure to be listed as a driver on the policy.

Mindful decisions on the road and wise policy choices at home can pave the road to savings for young drivers. Follow these steps, and you’ll not only protect your wallet but also build a solid foundation for your insurance history.

Navigating Insurance As A Young Driver

Finding affordable insurance for young drivers can feel like a maze. Costs are high.

But there are smart ways to save. Let’s make the complex simple.

Understanding Policy Terms

Insurance documents are full of jargon. Feeling lost is common. But knowing key terms saves money.

- Premium: The price you pay for insurance.

- Deductible: What you pay before insurance kicks in.

- Coverage: Protection you get from your policy.

- Exclusion: What’s not covered.

- Limit: The highest sum that your insurance will cover.

Tip: Look for a low deductible and high coverage.

When To Re-evaluate Your Coverage

As your life changes, so should your insurance. Don’t overpay. Here’s when to check:

- After getting married.

- Buying a house.

- Adding another car.

- When you turn 25.

Review yearly. Your rates might drop.

Cheapest Cars To Insure For 18-Year-Olds

When it comes to finding affordable car insurance for 18-year-olds, certain cars stand out for their lower premiums. Firstly, the Honda Civic is a favorite due to its reliable safety features and strong resale value.

Secondly, the Toyota Corolla makes the list, renowned for its dependability and cost-effective maintenance. Another great option is the Ford Fiesta, which is not only economical to purchase but also to insure, thanks to its compact size and efficient fuel consumption. The Subaru Outback also earns a spot, appealing to young drivers with its adventure-ready design and impressive safety ratings.

Lastly, the Mazda 3 is known for its excellent handling and affordability, making it a smart choice for budget-conscious young adults. Choosing any of these vehicles could lead to significant savings on insurance costs for 18-year-olds, making them practical choices for their first foray into car ownership.

Cheapest Car To Insure For 17-year old

Finding the cheapest car to insure for a 17-year-old can feel like a daunting task, given the typically high insurance rates for young drivers. However, certain cars tend to be more economical when it comes to insurance costs for teenagers.

For instance, smaller cars like the Ford Fiesta are often a go-to choice, thanks to their affordability and high safety ratings. The Hyundai i10 is another excellent option, offering not just low insurance premiums but also impressive fuel efficiency, which can help keep running costs down. The Volkswagen Polo, with its solid build and reliability, also tends to attract lower insurance rates, making it a smart pick for 17-year-olds looking for their first car.

It’s important to remember that while the make and model of the car play a significant role in insurance costs, factors such as the car’s age, engine size, and safety features can also impact premiums. Opting for a car with a strong safety record and a smaller engine can be a key strategy in reducing insurance costs for young drivers.

Good First Cars For 17-Year-Olds

Selecting a good first car for a 17-year-old involves balancing safety, affordability, and reliability. Here are some excellent choices:

- Toyota Yaris: This car is known for its reliability, compact size, and excellent fuel efficiency, making it an ideal choice for young drivers. Its safety features and low running costs also contribute to its appeal.

- Ford Fiesta: A favorite among new drivers, the Ford Fiesta stands out for its affordability, ease of driving, and stylish design. It also offers advanced safety technologies, which is crucial for inexperienced drivers.

- Honda Civic: For those looking for a blend of safety, efficiency, and technology, the Honda Civic is a strong contender. It’s well-regarded for its durable build and comes with a range of features that appeal to young drivers.

- Volkswagen Polo: Renowned for its solid build quality and reliability, the Volkswagen Polo is another excellent choice. Its compact size makes it easy to handle, and it comes equipped with impressive safety features.

- Kia Rio: The Kia Rio is a budget-friendly option that doesn’t skimp on safety or style. It offers good fuel economy, a comfortable ride, and a range of standard features, making it a great choice for first-time car owners.

When choosing a first car, 17-year-olds and their families need to consider factors such as insurance costs, the car’s safety rating, and overall maintenance expenses to ensure the choice is both practical and safe.

Worst Cars To Insure For Young Drivers

For young drivers, certain cars can come with exorbitant insurance premiums due to factors like high repair costs, powerful engines, and a lack of safety features. Here are some of the worst cars to insure for young drivers:

- Sports Cars: Vehicles like the Ford Mustang, Chevrolet Camaro, and Dodge Challenger are notorious for their high insurance costs. Their powerful engines and sporty designs make them more prone to accidents and theft, leading to inflated premiums for young drivers.

- Luxury Cars: Luxury vehicles such as BMW, Mercedes-Benz, and Audi models often come with steep insurance rates. Their expensive parts and repair costs, coupled with the perception of being more attractive to thieves, contribute to higher premiums for young drivers.

- Large SUVs: While SUVs are popular for their spacious interiors and versatility, larger models like the Ford Expedition or Chevrolet Suburban can be costly to insure for young drivers. Their size and weight increase the severity of accidents, leading to higher insurance premiums.

- High-Performance Cars: Cars known for their speed and agility, such as the Subaru WRX, Mitsubishi Lancer Evolution, and Nissan 370Z, tend to have sky-high insurance costs for young drivers. Their powerful engines and aggressive driving dynamics make them riskier to insure.

- Modified Cars: Vehicles that have been extensively modified with aftermarket parts or upgrades often come with inflated insurance premiums. Modifications like engine enhancements, body kits, and aftermarket exhaust systems can increase the risk of accidents and theft, driving up insurance costs for young drivers.

When shopping for a car, young drivers must consider not only the upfront cost but also the long-term expenses, including insurance premiums. Opting for a car with a good safety rating, modest engine size, and reasonable repair costs can help mitigate insurance expenses for young drivers.

Cheapest Car To Insure For 16-Year-Old Boy

For a 16-year-old boy, finding the cheapest car to insure is essential to keep overall expenses manageable. Generally, cars with smaller engines, good safety features, and lower repair costs tend to have more affordable insurance rates. Some options to consider include:

- Honda Fit: This compact car is known for its reliability, fuel efficiency, and affordable insurance rates. Its small size and strong safety ratings make it an attractive choice for young drivers.

- Toyota Prius C: The Prius C combines excellent fuel economy with low insurance costs, making it a practical option for teenage drivers. Its hybrid technology also appeals to eco-conscious individuals.

- Ford Focus: With its solid safety features and reasonable repair costs, the Ford Focus often comes with competitive insurance premiums for young drivers. Its compact size and easy handling make it a popular choice.

- Hyundai Elantra: The Elantra offers good value for money, with low insurance rates and a spacious interior. Its reliability and fuel efficiency further contribute to its appeal as a first car for 16-year-old boys.

- Chevrolet Sonic: The Sonic is another affordable option with relatively low insurance costs for teenage drivers. Its agile handling and modern features make it a fun and practical choice for young motorists.

When selecting a car for a 16-year-old boy, it’s crucial to prioritize safety, reliability, and affordability. Additionally, maintaining a clean driving record and taking a defensive driving course can help further reduce insurance premiums for young drivers.

Cheapest Car To Insure UK

In the UK, finding the cheapest car to insure involves considering factors such as the vehicle’s insurance group, its safety features, and its overall reliability. Some of the cheapest cars to insure in the UK include:

- Skoda Citigo: This compact hatchback is known for its low insurance costs, thanks to its small engine size and excellent safety features.

- Volkswagen Up!: Similar to the Skoda Citigo, the Volkswagen Up! offers affordable insurance rates due to its compact size and efficient engine.

- Citroen C1: The Citroen C1 is another popular choice for its low insurance premiums, economical running costs, and stylish design.

- Ford Fiesta: While not the cheapest option, the Ford Fiesta is often considered affordable to insure due to its wide availability of parts and strong safety record.

- Toyota Yaris: The Toyota Yaris is known for its reliability and low maintenance costs, which contribute to its competitive insurance rates in the UK.

- Peugeot 108: This city car is favored for its low insurance group rating, making it an attractive option for young and new drivers.

- Renault Twingo: The Renault Twingo’s compact size, efficient engine options, and reasonable repair costs help keep insurance premiums affordable.

When searching for the cheapest car to insure in the UK, it’s important to obtain insurance quotes for multiple vehicles and consider factors beyond just the initial purchase price. Insurers take into account various aspects of the car, including its safety features, repair costs, and theft rates, when determining insurance premiums.

Frequently Asked Questions Of Cheap Insurance Cars For Young Drivers

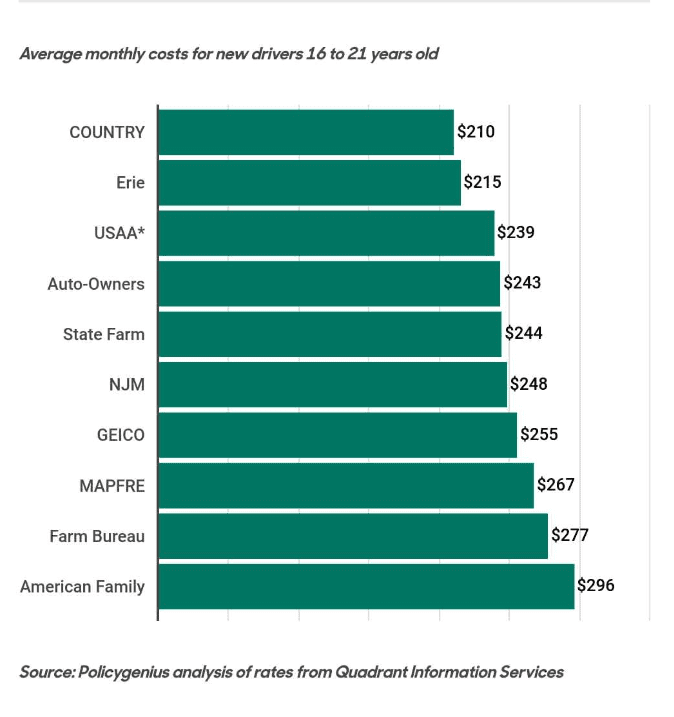

Which Car Insurance Is Cheapest For Young Drivers?

The cheapest car insurance for young drivers often varies, with companies like Geico, State Farm, and USAA frequently offering competitive rates. Always evaluate quotes to get the greatest possible offer.

What Is The Cheapest Car For New Drivers To Insure?

The cheapest car to insure for new drivers is typically a small, used vehicle with safety features and a low engine capacity. Popular options include the Ford Fiesta and Toyota Yaris.

Which Vehicle Is Cheapest To Insure?

The cheapest vehicle to insure often varies, but typically, small SUVs and minivans hold the lowest insurance premiums.

What Car Is Best For A 17-Year-Old?

The best car for a 17-year-old is a safe, affordable, and reliable model with low insurance costs such as the Honda Civic or Toyota Corolla.

Conclusion

Selecting the right car for affordable insurance doesn’t have to be a challenge for young drivers. By focusing on safety features, reliability, and insurance group ratings, cost-effective options become clear. Remember, the best choice balances budget, safety, and your unique driving needs.

Drive smart, save money, and stay safe on the roads.

Koushik Kumar Sarkar, a seasoned content writer, specializes in demystifying insurance complexities. With a knack for crafting clear and engaging narratives, he empowers readers to make informed decisions about their coverage. Koushik’s expertise spans various insurance domains, making him a go-to resource for accessible and insightful content. Connect with him for concise, informative, and impactful insurance insights.