The content is about How to Check Car Insurance Expiry Date.To check your car insurance expiry date, examine your policy document or contact your insurance provider. Alternatively, you may log in to your insurer’s online portal if available.

Understanding when your car insurance expires is crucial to ensure continuous coverage and legal compliance. Remaining aware of your policy’s validity prevents lapses that can lead to fines or issues in the event of an accident. Checking the expiry date should be a part of your routine vehicle maintenance schedule.

Staying informed about your car insurance details is not just practical—it’s a legal necessity. Driving with an expired policy can lead to severe penalties and put you at significant financial risk. A well-timed check of your insurance details ensures you’re always covered and gives you peace of mind while on the road. This proactive step is an essential aspect of responsible vehicle ownership and can save you from unexpected legal troubles. Always mark the expiry date in your calendar and set reminders to renew your policy well in advance.

The Importance Of Insurance Validity

Keeping track of your car insurance expiry date is crucial. It’s not just about compliance but also about ensuring you’re protected every time you hit the road. A lapse in coverage can lead to serious risks and legal implications. Understanding these can motivate you to stay on top of your policy’s status. Let’s delve into the risks associated with a lapsed car insurance policy and what happens if you’re caught with expired coverage.

Risks Of Lapsed Car Insurance

If your car insurance has expired, you’re at risk on multiple fronts:

- Financial Liability: Without insurance, costly bills from accidents land on you.

- Unprotected Assets: Your car, a valued asset, stays uncovered against theft, damage, or loss.

- No Peace of Mind: Driving without insurance equates to the constant worry of ‘what if’ scenarios.

Legal Implications Of Expired Coverage

The law takes a serious stance on driving without valid insurance:

- Penalties and Fines: Get caught and you’re facing hefty fines.

- Suspension of License: You might lose the right to drive legally.

- Increased Premiums: When you renew, expect higher rates post-lapse.

- Jail Time: In severe cases, it can lead to imprisonment.

How to Check Car Insurance Expiry Date

Keeping track of your car insurance expiry is crucial. It helps you renew on time. Doing this avoids driving uninsured. Let’s dive into how to find your insurance expiry date.

Insurance Policy Document Review

Start by checking your policy documents. They contain the expiry date. This method is direct but sometimes overlooked. You receive these when you buy or renew your policy. Look for the section titled ‘Policy Period’ or ‘Validity’. The expiry date is often in bold or highlighted to stand out.

| Document Section | Details Provided |

|---|---|

| Policy Period / Validity | Start and Expiry Date of your Insurance Policy |

| Coverage Details | Type of Cover and Benefits |

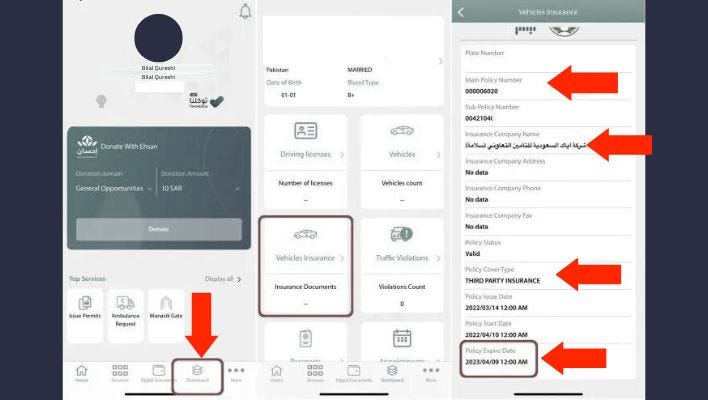

Online Account And Dashboard Checks

Many insurers offer online services. Log in to your account on their site. Once logged in, navigate to the dashboard.

- Look for a section labeled ‘My Policies’ or ‘Insurance Documents’.

- Click on your car policy.

- Your policy expiry date will be clearly shown.

This method is quick and easy. You can do it from anywhere. All you need is internet access.

Using Mobile Apps For Expiry Alerts

Keeping track of car insurance expiry can slip through the cracks in busy lives. Mobile apps serve as a convenient reminder system.

Such apps provide alerts before a policy expires. This ensures vehicles stay insured without interruption. Here are detailed methods to set up mobile notifications.

Setting Up Notifications Through Insurer Apps

Many insurance companies have their apps. These contain features for policy management. Here’s how to activate expiry notifications:

- Download your insurer’s app from the App Store or Google Play.

- Create an account or log in.

- Link your insurance policy to the app.

- Navigate to settings or notification preferences.

- Enable alert for insurance renewal.

With these steps, you’ll receive a prompt before your insurance lapses.

Third-party Reminder Applications

If your insurer lacks an app, third-party applications are a viable option. These apps track various expiration dates and send reminders.

- Choose a reputable reminder app.

- Download and install it on your phone.

- Set the insurance expiry date within the app.

- Configure the app to send pre-set reminders.

This method ensures you do not miss the expiry date even if you switch insurance providers.

Contacting Your Insurance Provider

Contacting Your Insurance Provider is a surefire way to check your car insurance expiry date. Your insurance company holds all necessary information regarding your policy, including key dates. A quick interaction with them can provide you with precise details about your insurance status.

Phone Inquiry For Expiry Information

Calling your insurance company directly is a straightforward method to obtain your expiry date. Follow these simple steps:

- Locate the customer service number on your insurance card or company’s website.

- Dial the number and select the option to speak with a representative.

- For verification, please provide your policy number and personal information.

- Ask the representative for the expiry date of your insurance policy.

Email And Online Support Options On How to Check Car Insurance Expiry Date

Most insurance providers offer digital channels to assist customers. Here’s how you can use them:

- Send an email to the support address with your policy details, requesting the expiry information.

- Log into your account on the insurer’s website or mobile app to view your policy details and expiry date.

- Use the online chat feature, if available, for instant communication with a support agent.

Staying Proactive With Renewals

Knowing when your car insurance expires is crucial. It can save you from legal troubles and potential fines. Staying on top of your car insurance renewals is not just responsible; it’s also smart. Let’s look at how you can be proactive with your renewals.

Calendar Reminders For Policy Expiration

Never forget an important date again. With the digital world at your fingertips, setting up reminders has never been easier. Use these tips to help you stay ahead:

- Smartphone Calendars: Mark the date a month before expiry. Set multiple alerts.

- Email Alerts: Many email services allow for scheduled reminders.

- Physical Calendars: For those who prefer a visual cue, circle the expiration date in red.

Benefits Of Early Renewal

Renewing your car insurance before it expires offers significant benefits:

| Benefit | Explanation |

|---|---|

| Uninterrupted Coverage | No coverage gaps mean constant protection. |

| Financial Savings | Some insurers offer discounts for early renewals. |

| Better Rates | Renewing early can avoid increases due to last-minute rush. |

| Peace of Mind | With insurance sorted, you can drive worry-free. |

Frequently Asked Questions For How To Check Car Insurance Expiry Date

Can I Check My Car Insurance Expiry Date Online?

Yes, most insurance providers offer an online portal where you can log in and view your policy details, including the expiry date of your car insurance.

What Documents Are Required To Find Insurance Expiry?

To check your insurance expiry date, you’ll need your policy number or vehicle registration details. These can typically be found on your insurance card or in your policy documents.

Where To Find Car Insurance Expiry Information?

Car insurance expiry information can be found on your insurance policy document, the insurer’s website, or by contacting your insurance agent. It’s often listed clearly on the first page or in a summary section.

Do Car Insurance Companies Remind You Of Expiry?

Yes, most car insurance companies send reminders via mail, email, or SMS as your policy’s expiry date approaches, to encourage timely renewals and continuous coverage.

How To Check Your Car Insurance Expiry Date Online

Thanks to the availability of internet tools, keeping track of your auto insurance expiration date has never been easier.

You may now easily verify your insurance status while on the go or in the comfort of your own home. The majority of insurance companies provide easily navigable mobile apps or web sites where you may see your policy details and log in.

All you have to do is choose the appropriate section to view the information on the length of your insurance, including the expiration date.

In addition to saving you time, this digital convenience makes ensuring that you continue to be proactive and informed about keeping your car insured.

Accept the ease of determining the expiration date of your auto insurance online and drive with assurance that your coverage is current.

How To Check Car Insurance Status

Checking your car insurance status is a straightforward process. Start by reviewing your insurance documentation, which typically includes details about your coverage and its expiration date. Alternatively, contact your insurance provider directly through their customer service hotline or visit their website.

Most insurers offer online portals where you can log in using your credentials to access your policy information, including the current status.

If you prefer a quick check, consult your insurance ID card, which often indicates the coverage period. Staying informed about your car insurance status ensures that you drive with confidence, knowing you have active and reliable coverage in place

Conclusion

Keeping tabs on your car insurance expiry is crucial to avoid lapses in coverage. By following the methods outlined, you can easily stay informed and adhere to legal requirements. Remember, regular checks safeguard your wallet and keep you driving with peace of mind.

Stay covered, stay safe on the roads.

Read More

- Car Insurance for Young Drivers Under 1000 – 5 Must-Know Tips for Affordable Protection!

- No Deposit Car Insurance – Drive Secured Without the Upfront Hassle

Koushik Kumar Sarkar, a seasoned content writer, specializes in demystifying insurance complexities. With a knack for crafting clear and engaging narratives, he empowers readers to make informed decisions about their coverage. Koushik’s expertise spans various insurance domains, making him a go-to resource for accessible and insightful content. Connect with him for concise, informative, and impactful insurance insights.